[Estimated read time: 5 minutes]

What is Condominium?

A condominium is an individual unit that is within a larger building, similar to an apartment style building. As a condo owner, you are investing in a shared interest in a community with a group of other owners. An HOA governs and maintains the community and the common areas. Funded by a monthly maintenance fee that is collected from the residents living within the association.

Steps to Buying a Condo

Let's take a quick look at what to expect during the process of buying a condominium, a patio home, or even a townhome. These are all similar styles of properties and are usually categorized the same and present the same approach when analyzing a property.

1. Find an Agent (and Loan Officer)

Look for an experienced agent that is familiar with navigating through a condo transaction and also a loan officer who is also experienced with working with condo associations. When purchasing a condo there are even more documents that need to be rectified to move forward. Make sure that the real estate agent you hire has the experience that is needed when it comes to purchasing a condominium. They can better help you understand what to look for when deciding on a certain condo development. Doing so will help make the process easier and more manageable considering they understand the process more.

Important Questions to Ask Your Real Estate Agent:

⚬ How long have you been in the Real Estate business?

⚬ What areas do you serve?

⚬ Do you have a list of past client testimonials?

⚬ How many Buyers are you currently working with?

⚬ Why should I use you to help with Buying a condo?

2. Get Financing

It is always important to talk with a lender before buying a home or a condo. Fully understand what your budget should be. Finding out what type of loan you will have can also make an impact on choosing a condo community.

There are numerous condos for sale across the United States that are not VA or FHA approved and may require different financing in order to purchase the condo.

What kind of Loan should I get?

One of the most important things to consider when buying a condo is what type of financing. Below is a quick look at the different kinds of loans that may be available to you.

Different Types of Loans:

Fixed Rate Mortgage

A fixed-rate mortgage carries an interest rate that is locked in and stays the same throughout the life of the loan.

Adjustable Rate Mortgage

As for the adjustable-rate mortgage (ARM’s), the interest rate can change periodically and your rate can either increase or decrease from time to time.

Conventional Loans

A conventional loan usually requires a larger down payment and has its benefits. This type of loan is not guaranteed or insured by any government agency, such as the Federal Housing Administration (FHA)

FHA Loans

Federal Housing Administration mortgages has its benefits, such as lower down payments. These loans are available to all borrowers and not just limited to first-time homebuyers. One disadvantage of an FHA loan is the additional expense of mortgage insurance (PMI).

VA Loans

U.S. Department of Veterans Affairs offers mortgage loans to eligible military service members and their surviving spouses as long as they do not remarry.

3. Start Searching

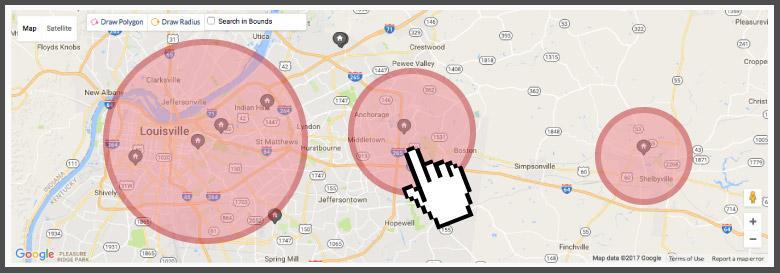

If buying a condo is right for you, it's time to narrow down your search parameters to the perfect condo for sale. Do some research on what you can buy based on the price range your budget can afford. Location and nearby attractions may be important but most condo buyers are really looking at buying a condo because of the exterior maintenance. There is less upkeep as an owner, and you can enjoy your time off by spending it doing other things then yard work and preventative maintenance around the house.

Some other benefits of living in a condo are the amenities. If you are looking for a condo with a pool, a clubhouse, or even an exercise room. Filter your search to narrow it down to condos that have these amenities.

Keep in mind, usually when a condo development has more amenities, the monthly maintenance fee can be more. So if you are not looking for a condo with these kinds of amenities, you may want to find one without so you can possibly save on the monthly maintenance fee.

4. Make an Offer

You found the perfect condo to buy. Now that you are ready to move forward, it's time to make an offer. Condominiums are usually very easy to do a CMA on. Especially in a larger development with 60+ units. There may be an 8% - 10% turn around each year. Meaning that on average, each year there can be 5-6 condos that hit the market. Giving a potential buyer enough information on what the market value is for a condo in that neighborhood.

Things to Consider When Making an Offer:

⚬ How much are the property taxes?

⚬ What is the monthly maintenance fee?

⚬ Is there a set increase (percentage wise) every year for the Maintenance fee?

⚬ Is there an up to date or revised copy of the Restrictions/ByLaws?

⚬ Are there any upcoming special assessments that the current condo residents may have to pay?

⚬ Is there an actual company managing the Condo Association or is it self-ran by Condo residents?

⚬ Can I see a copy of the Condos Association Budget/Balance sheet?

5. Condo Inspection

Just like when you are buying a home it is crucial to have a home inspection. Even though, the majority of condominiums have exterior maintenance that is handled by the HOA. It is still important to have an inspection when purchasing a condo to make sure there is no deferred maintenance that the HOA is unaware of. A good home inspector will comb through the interior and will likely find things that need some attention. If you are not sure who to hire for the home inspection, ask your real estate agent for recommendations. Typically you will receive a list of different professionals that you can choose from.

6. Appraisal

Now that you are past the inspections and the repair request has been made. It's time for the lender to order the appraisal. An appraiser will come out to the condo and verify that the value of the condo meets or exceeds the amount of the loan. This protects the lender so they are not loaning money on real estate that is less than the actual loan amount. If the appraisal comes in low or with conditions that need to be addressed, you will need to notify the listing agent and seller to renegotiate the sale price.

7. Condo Insurance

When buying your first condominium you will want to reach a few different insurance companies to get quotes. It may be better if you have a trusted insurance broker that can help not only find the best rate but also a trusted insurance company with high financial rating to show you likely they are to fulfill a claim.

Obtaining insurance on a condominium is considerably less than the typical cost of homeowners insurance. Even though the association may have its own insurance policy. That usually only covers what is beyond the exterior walls of the condo unit. Having your own insurance policy in place helps protect the things on the inside of the unit. Insurance companies refer to this as "wall to wall" coverage.

8. Set Up Utilities

Getting your condo ready for the day you move in. Contact the local providers in the area to set up the utilities in your name. It is recommended to have them transferred over the day of the closing. Not the day after. Typically, the condo associations don't allow satellite dishes so you will want to check to make sure you are familiar with the bylaws and restrictions.

9. Final Walk-through

Getting closer to closing time. Now that you got the ok to close you will want to schedule a final walk-through. At this time it is important to make sure all of the repairs have been completed and there are copies of all invoices. You're soon to be, new condominium should also be broom cleaned and ready to be moved in at this point. Check to make sure nothing has been damaged when the previous owner was moving things out.

10. Closing

Congratulations on the purchase of your new condo. It is now time to close on your new condo. Don't forget to bring your license and be ready to sign pages and pages of documents. If you haven't already, get a copy of the contact information for the HOA. Also, find out arrangements that are in place to pay the monthly maintenance fee and any mailing addresses. Sometimes buyers and sellers will exchange their own personal contact information just in case there are any questions after closing.

Closing Thoughts on Buying a Condominium

Hopefully, this article provides the general information needed for anyone who is considering buying a condo. One downfall I have noticed here locally is that condos don't usually appreciate at the same rate as a home naturally would. What are your thoughts on living in a condominium?

Posted by Nathan Garrett on

I agree that when you are looking for a condo the first thing you would want to do is find an agent. It would seem that if you have a good realtor working with you the whole time the process would be much easier. I'm looking for a condo nearby to move to so I'll have to find a real estate agent to help me through the process as well.

Posted by Olivia Nelson on Monday, March 13th, 2017 at 6:19pmI had no idea that there was condo insurance! I have been looking into getting a condo for some time now, but I think that now we're getting serious about it, getting a realtor's help would be smart. I'm sure that a realtor knows about condo insurance, and could suggest the good companies to me to talk to.

Posted by Max Jones on Monday, April 17th, 2017 at 5:57pmThis is a great step-by-step guide of what homebuyers can expect when purchasing a condo. One step that I would add, is the interview with the board of the condo association. I know that this might not be a necessary step in all locations, but here in South Florida, homebuyers usually have to be interviewed and approved by the Home Owners Association when purchasing a condominium. Great article!

Posted by Stephanie Kukich on Thursday, April 20th, 2017 at 12:16pmThat is a great suggestion Stephanie - thanks for sharing!!

Posted by Nathan Garrett on Friday, April 28th, 2017 at 7:02pmI am also looking for the condo for my friend who lives in Calgary. I like the way that you described it info graphic is very attractive. Surely, I follow all the instructions before buying a condo. Thanks!

Posted by Marry Claire on Wednesday, May 3rd, 2017 at 8:39amMy husband and I have been wanting to rent a condo for some time now. We have only been looking at condos in the area where we want to move. I didn't, however, think about checking if there are special assessments that a resident should pay like an HOA fee. We have not problem paying those, but knowing ahead of time will allow us to fit that in our budget.

Posted by Precious Leyva on Wednesday, May 24th, 2017 at 2:10pmThanks Precious Leyva. glad it was helpful :-)

Posted by Nathan Garrett on Wednesday, May 24th, 2017 at 8:38pmThis is a great and very detailed post. Nice inforgraphic, too! People will actually know how to find and buy a condo with this article. Thank you!

Posted by Canadian Flood Restoration on Tuesday, June 6th, 2017 at 1:43pmI like how you say that you need a home inspection for a condo as well. It would seem that you would want to find someone to inspect it before you are going to sign a contract. My sister is looking to move out of her apartment and into a condo, so she'll have to get it inspected as well.

Posted by Gloria Durst on Wednesday, June 7th, 2017 at 4:11pmI want to buy a condo, but I don't even know where to start. It makes sense that getting an agent would be a great way! That way I can have someone who can help me through the rest of the steps.

Posted by Braden Bills on Friday, June 16th, 2017 at 10:24amThanks for sharing some top tips for buying a condo, I really like your article and I'm sure people would find best information from this blog.

Posted by Jon O'Connell on Friday, June 23rd, 2017 at 11:43amI am wanting to move out of my parent's basement, and into a place of my own. It's good to know that when it comes to getting a condo, one thing that I will have to remember to talk to my agent about the different market values of that area. It will be nice to make sure that I am getting the best price for my future place of living.

Posted by Harper Campbell on Wednesday, July 19th, 2017 at 3:34pmI totally agree with what you said about finding an agent if you plan to buy a condo unit. One way to getting a reputable real estate agent is by searching for online reviews and testimonials. This way, you would have an idea about what other people have to say about a specific agent. Also, you may want to ask for recommendations from friends and family as well. They may be able to recommend somebody whom they have worked with before. This should certainly give you an informed decision if the agent is indeed the right one for you. If I ever plan to buy a condo, I would make sure to take this into account. Thanks.

Posted by Bobby Saint on Friday, November 24th, 2017 at 11:38pmI totally agree that it is important to request a home inspection before purchasing a certain unit to make sure that everything in the unit and the building meets your needs and wants. My sister is looking to buy a condominium unit for her son who's about to graduate from college. It's important for her to find the perfect unit that her son will appreciate. I will make sure to share your blog with my sister so she can get some tips on choosing a condo unit.

Posted by Sharon Wilson Smith on Thursday, November 30th, 2017 at 6:36pmIt was helpful when you talked about condo insurance. My uncle is thinking about buying a condo. The info in your article should help him plan to avoid issues!

Posted by Deanna Lynne on Friday, May 21st, 2021 at 3:37pmLeave A Comment