Good news! The value of your home has gone up. The bad news is your property taxes likely have too.

However, if you believe your taxes have been unjustly increased, you have the option to appeal your Jefferson County property taxes.

How does the PVA Determine Property Values?

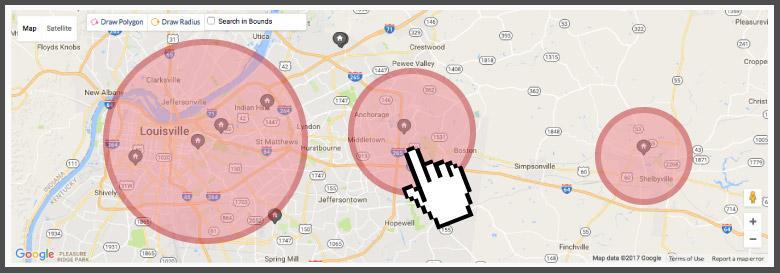

Each time there is a sale in your neighborhood the local PVA office will enter the data into their system to record the transaction. The sale price will then represent the value of the property for approximately the next two years.

Jefferson County PVA uses a computer-assisted mass appraisal system (CAMA) to determine the property values for more than 250,000 homes.

However, even with careful monitoring, inaccuracies can occur. Potentially leading to higher tax assessments for some property owners. Periodically the PVA will re-assess certain areas. When this takes place, many homeowners in the area may see an increase in their property taxes.

Appealing Your Property Taxes

Since appeals are restricted to a designated period, appealing your Louisville property taxes can only be done during a limited time. Also known as the annual Open Inspection Period.

The first step is to visit the Jefferson County PVA website to find out when the PVA Online Conference is held - as required under state law (KRS 133.120). Which typically starts on the first Monday of May and runs for 13 days, including two Saturdays.

Preparing for the Conference

First, check to make sure that the information the PVA has on your property is correct and that there are no discrepancies. Such as the number of bedrooms, bathrooms, and the square footage. Even the size of lot.

When preparing for the conference, you have the option to represent yourself or to select a representative.

The following is a list of representatives:

- An attorney

- Certified public accountant

- Real estate broker or Kentucky licensed real estate broker

- An employee of the property owner

- Licensed or certified Kentucky real estate appraiser

- An appraiser with a temporary practice permit or reciprocal license or certification in Kentucky whose license or certification within the Uniform Standards of Professional Appraisal Practice

- Any other individual with a professional appraisal designation recognized by the department.

Find Comparable Sales

In the past, the PVA has allowed the public to have access to the sold data two weeks before and during the Open Inspection Period (OIP). To check, you can contact customer service at the PVA Office to learn more. Furthermore, they even hold in-person appeal assistance at different library locations.

It is important that when looking for comparable homes to support the appeal, you look closely at each property. You will notice that there are different styles of homes. To find the true market value, you must only compare a property to similar-style homes. Also, use comparables that are similar in age and size. Before getting started, you may want to find information on how to correctly price a home. This will help guide you in selecting accurate like-kind properties.

Gather Supporting Documentation

Once you have found comparable properties that have recently sold that support the inaccurate evaluation. You will want to print them out and use them as examples. Some homeowners will also consider hiring an appraiser to do a full report on their home if they believe the taxes are higher than they should be.

Once you have found comparable properties that have recently sold that support the inaccurate evaluation. You will want to print them out and use them as examples. Some homeowners will also consider hiring an appraiser to do a full report on their home if they believe the taxes are higher than they should be.

Make notes or even take pictures of the interior or exterior of your home to show condition or if repairs and updates are needed to further support the inaccurate value from the PVA

Important documentation that you will want to include:

- Detailed interior and exterior photos of your property.

- A current full appraisal.

- Evidence of comparable sales.

- Other relevant documents like insurance policies or repair estimates.

Delivering Supporting Documents

Once all of your supporting documents are together you will need to turn them in as soon as possible. You necessarily have 7-days to file or before the closing of the Open Inspection deadline. Whichever comes first. But time is of the essence, so do not delay turning them in.

You can either hand deliver or mail your documents to the Jefferson County PVA office.

Jefferson County PVA Office

Attn: Conferencing

Glassworks Building

815 W. Market St. #400

Louisville KY 40202-2654

Moving Forward with Your Appeal

If the issue isn't resolved at the PVA level, the next step is to appeal to the Local Board of Assessment Appeals (LBAA). Following your conference, you'll receive a result form which must be submitted to the Jefferson County Clerk’s office as instructed. They will schedule your hearing and notify you of the date and time.

Further Appeals

Should the LBAA decision not meet your expectations, you can escalate your appeal to the Kentucky Board of Tax Appeals. This further step involves more detailed preparation, and guidance on this process can be found at the Kentucky Claims Commission-Tax Appeals website.

Posted by Nathan Garrett on

Leave A Comment