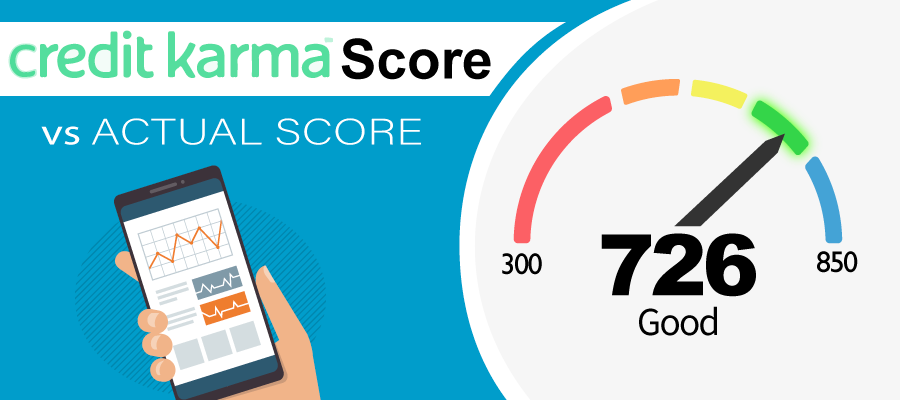

Credit Karma vs Actual Credit Score

When it comes to buying a home and getting pre-approved, one of the most important numbers is our credit score. This little three-digit number carries a world of importance and can have an impact on many things in our lives. Surprisingly, millions of adults do not actively monitor their credit scores and millions more don’t understand the importance of having a good score. If you are looking to develop solid financial habits and improve your financial health, learning where and how to monitor your credit score is an important first step in accomplishing these goals.

Credit Karma ranks towards the top of the list year after year when we discuss free services that allow users to monitor and help to understand their credit scores. However, as some users have noted, there does appear to be some discrepancies between what Credit Karma reports when compared to other credit monitoring services. Let’s take a closer look at what goes into the score that Credit Karma reports and if it is an accurate indication of your actual credit score.

Why Bother with Monitoring my Credit Score?

If you’ve tried to apply for a loan, a car, or even get an apartment, chances are that you have had to have your credit profile pulled. A strong credit score opens numerous doors for us and contributes to a healthy financial life which can lower stress levels and increase our overall happiness. It can also have a big impact on obtaining a home mortgage and how much house you can afford.

Having a good credit score is more than just something to brag about. When loan companies and lenders see a strong credit score, they will extend more favorable terms which will ultimately save you money over time. Less money paid in interest means more money for you to do whatever you’d like, whether that’s spending, saving, planning your retirement, or even paying off your home early.

A bad credit score raises numerous red flags for lenders and can put some major obstacles in your way when it comes to trying to do just about anything that involves finances in life. Any loans that you are approved for will have less than stellar terms and that means you’ll pay far greater amounts per month in interest and over the life of the loan. More money paid in interest means less money for you to do what you want to do and need to do. Any time you need to make a purchase, a poor credit score will loom like a dark cloud over your life. By actively monitoring your credit score and gaining a sense of the importance of keeping your score in a respectable range, you will be on the right path and on your way to a stable financial future. Furthermore, credit reporting agencies make mistakes. If you’re not in the practice of actively checking over your credit report, you could be victim to errors and mistakes wreaking havoc on your overall score.

Sites like Credit Karma put the power in your hands to stay on top of your score and on any potential detrimental marks reported on your credit profile. But as we have mentioned, your Credit Karma score may not be the exact same as the score you see on other websites or through your credit card companies.

What Does Credit Karma Provide and What Do They Do?

Credit Karma provides a free service that enables users to view their credit reports and scores in an instant. You simply need to sign up with your email address to gain this instant access. A little-known feature of the site is that it provides users with the option to deposit money into a high yield savings account, too. A high yield savings account simply means that your deposited money will earn a higher amount in interest than in an account held at most brick-and-mortar bank. One of the best parts about the savings account is that there are no hidden fees or costs to deposit your money, making it an incredibly attractive option for users.

Signing up for Credit Karma is a painless process and all it takes is an email address and having some of your personal information ready to input. Once they have what they need, they’ll be able to access your various credit reports and then issue you your score in a short period of time.

Luckily, all these services are absolutely free. They may offer third-party services that can be purchased, which is how they make their money, but accessing and monitoring your credit are entirely free. If you choose to click on any of their affiliate links or purchase anything that they suggest, you may do so at your own discretion. Credit Karma does offer some great services, however, and part of the reason they are able to continue to offer their core reporting and monitoring services free of charge is due to their users’ purchasing of products through their site. Whatever your situation, make sure that anything you click on or are considering for purchase makes sense for your short- and long-term financial goals and is in your best interest.

Is Credit Karma Accurate?

One of the questions that users wonder is if Credit Karma is accurate and a legitimate service. This is a valid question, after all, considering that free services often wind up being too good to be true. However, Credit Karma does provide a reasonably accurate and precise picture of your credit score. While the service's accuracy is generally on point, there will be noticeable discrepancies between your Credit Karma score and scores observed via other sources.

How Credit Karma Determines Scores?

Credit Karma uses what is called the VantageScore model. The most popular scoring model is the FICO scoring model. FICO stands for the Fair Isaac Corporation, which is one of the largest companies that calculates credit scores. Since Credit Karma uses a different scoring model, it should be clear that this is a source of discrepancies. The three major credit bureaus are Equifax, TransUnion, and Experian. Credit Karma uses only two of these credit unions when determining their users’ scores, however. Your Experian score is not factored into their algorithm which may skew the accuracy of your score when cross-referenced with other reporting agencies. There is some delay in how long it takes for information to reach Credit Karma’s system. Credit Karma will receive any payment, or delinquency notices only after one of the major credit bureaus is notified, which will than cue Credit Karma in on your latest activities. This means that your score may not be updated for a week or more at a time, depending on your activities and the speed at which your information is reported to one of the two major bureaus that Credit Karma uses.

Something to think about is the fact that if you have a generally strong score, or on the flip side, a poor score, it will be reflected in any of your credit reports, regardless of where you look. This means that when you’re applying for financing for a vehicle loan or a home mortgage, you’re not going to run into many surprises because the score reported to Credit Karma is a bit different than the agency that pulled your credit for your lender. Put into other terms, if Credit Karma reports your credit score as a 750, you’re FICO score isn’t going to suddenly come back as a 600. It may be a few points off from your Credit Karma score, but it won’t be anything that makes or breaks your prospects of qualifying for various loans.

Okay, But is Credit Karma Safe to use?

If you’ve read this far, you might be wondering at this point if Credit Karma is safe or has had any major data breaches or if they sell your data. The latest data points towards Credit Karma having a stable server that has not been exposed by hackers to any data breaches to date. There are no significant safety issues on record when it comes to using Credit Karma. The most sensitive piece of information that you’ll need to part with in order to use the site is the last four digits of your Social Security Number. Providing these digits is the only surefire way to allow Credit Karma to verify your identity and provide you with your most accurate credit scores. However, there are many services and websites of far less importance and utility that require you to provide these digits, so if making your financial health a priority is important to you, it should be worth the minor risk to sign up.

What if I Don't Like What I See?

Contrary to what some credit repair agencies might tell you, there is no magic way to make your score instantly increase. Developing healthy spending habits is the best surefire way to increase your credit score over time. Paying down debts is a great way to begin boosting your score, and if you can pay off your credit cards in full each month, this is a proven way to maximize your credit score. Additionally, setting your payments to autopay is a great tactic to ensure there are no missed payments to damage your score. The reality is that it can take several months and even years to reach the score you have in mind. Remaining consistent in your approach and not deviating from your plan are essential in getting there sooner than later.

Final Thoughts

Getting your finances in order can feel like a daunting task. If you haven’t been monitoring your credit history and haven’t been particularly responsible with your finances throughout your life, it may feel easier to just ignore your credit score entirely. While the “out of sight, out of mind” approach may give you some blissful ignorance, you’re not doing yourself any favors in the long run. Especially if you have dreams of becoming a homeowner in the near future.

Credit Karma is one of the industry leaders at providing users with a free snapshot of their current credit score and a look into one’s credit history and overall report. The information that is used to determine a user’s credit score is furnished from two of the three leading credit bureaus and helps provide a fully accurate indicator of what your current credit score looks like. While there will ultimately be discrepancies between your Credit Karma score and scores taken from other sites and agencies, the score you are provided with is known to be accurate and trustworthy. Monitoring your credit report and scores is a small step, but an important one in developing healthy financial habits that will continue to provide benefits for the rest of your life.

Posted by Nathan Garrett on

Leave A Comment